Introduction

Forex traders often face a choice: Copy Trading or Forex Signals? Both offer ways to trade without deep analysis, but they work differently. This guide compares the pros, cons, and best use cases for copy trading vs forex signals in 2025—helping you decide what’s best for you.

What Is Copy Trading?

Copy trading allows you to automatically replicate trades from professional traders in real-time. When they open or close a trade, your account does the same.

- Platforms: eToro, ZuluTrade, Myfxbook Autotrade.

- Set It & Forget It: Trades happen automatically.

What Are Forex Signals?

Forex signals are trade alerts you receive via Telegram, apps, or email. You place the trades manually based on provided instructions (entry, stop loss, take profit).

- More Control: You choose whether to follow each signal.

- Active Involvement: You manage the trades.

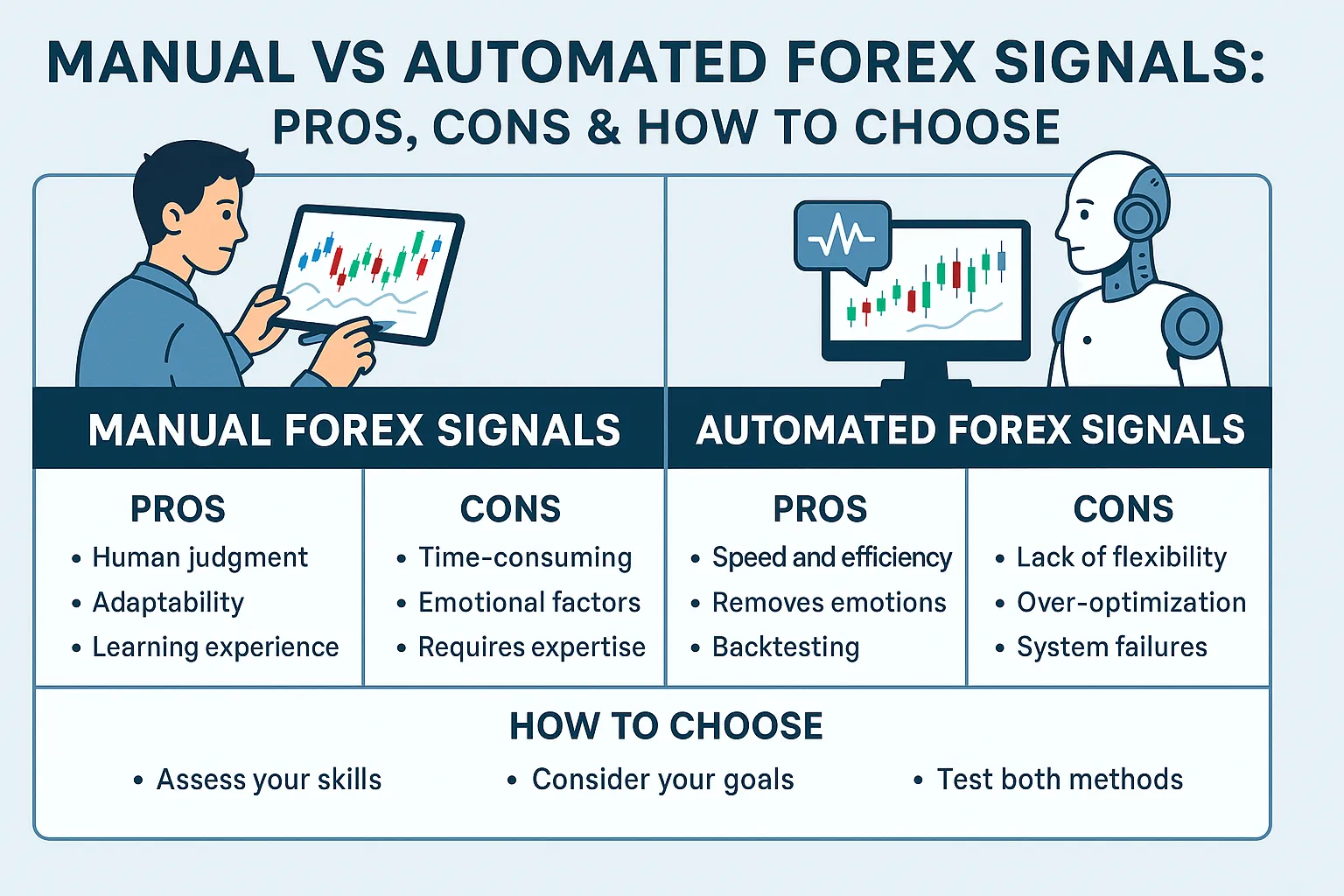

Pros & Cons: Copy Trading vs Forex Signals

| Feature | Copy Trading | Forex Signals |

|---|---|---|

| Automation | Fully automated | Manual execution required |

| Control | Less control over individual trades | Full control over each trade decision |

| Ease of Use | Beginner-friendly | Requires basic trading knowledge |

| Cost | Performance fees or platform fees | Free or subscription-based |

| Transparency | See trader’s history (if platform allows) | Signal quality depends on provider |

| Flexibility | Harder to switch strategies mid-way | Easy to skip trades or change providers |

When to Choose Copy Trading:

- You want completely hands-off trading.

- You trust the trader’s long-term performance.

- You prefer passive income strategies.

When to Choose Forex Signals:

- You like having control over each trade.

- You want to learn by analyzing signals.

- You enjoy manual trading and involvement.

Important Considerations:

- Risk Management:

- Copy Trading: Relies on the trader’s risk tolerance.

- Signals: You set your own risk levels.

- Costs:

- Copy Trading: Pay performance fees, spreads, or commissions.

- Signals: Subscription fees, or sometimes free.

- Performance:

- Both depend heavily on the provider’s skill and market conditions.

Which One Is Better in 2025?

There’s no one-size-fits-all answer.

- Choose Copy Trading if you want automation.

- Choose Forex Signals if you want flexibility and control.

Some traders even use both, starting with signals to learn, then moving to copy trading for convenience.

Conclusion

Both copy trading and forex signals have their place in 2025. If you want to trade passively, copy trading might suit you. If you prefer hands-on control and learning, forex signals are a better choice. Evaluate your goals, experience, and time commitment before deciding.

FAQs:

- Is copy trading safer than forex signals?

Both carry risk. Copy trading depends on the trader’s decisions, while signals depend on your execution. - Can I use both methods at the same time?

Yes, many traders combine them for diversification. - Which is more profitable?

It depends on market conditions and provider quality. - Do I need a large account for copy trading?

Some platforms allow small investments, but more capital helps with diversification. - Is manual trading better than both?

If you have skills and time, manual trading offers the most control.