Introduction

Forex signals come in two main types: Manual and Automated. Both help traders spot opportunities, but they differ in how they’re generated and used. In this blog, we’ll compare manual vs automated forex signals to help you decide which suits your trading style in 2025.

What Are Manual Forex Signals?

Manual signals are generated by human analysts who study charts, news, and market conditions. They send signals via Telegram, email, or apps.

- Example: A trader notices a trend and alerts followers to buy EUR/USD at a specific level.

What Are Automated Forex Signals?

Automated signals are created by algorithms or trading bots. They scan markets 24/7 and send signals based on pre-set criteria.

- Example: A bot detects a moving average crossover and sends a buy signal instantly.

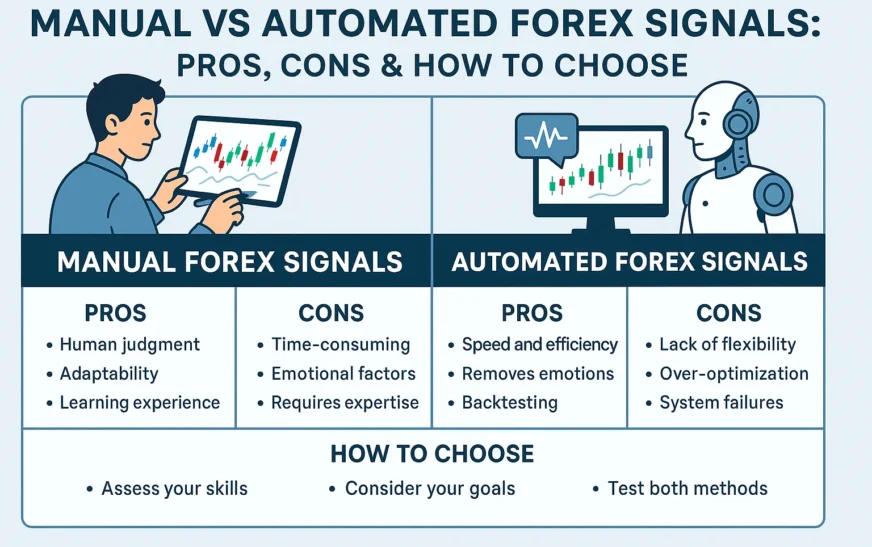

Pros & Cons: Manual vs Automated Forex Signals

| Feature | Manual Forex Signals | Automated Forex Signals |

|---|---|---|

| Source | Human analysis | Algorithm-based |

| Speed | May have delays | Instant signal delivery |

| Accuracy | Depends on analyst skill | Depends on algorithm logic |

| Flexibility | Can adapt to news/events | Rigid—follows pre-set rules |

| Emotions | Prone to human bias | Emotion-free |

| Customization | Limited to provider’s view | Highly customizable (if you build it) |

| Cost | Often subscription-based | Varies: free, subscription, or custom bot |

Advantages of Manual Forex Signals

- Human Insight: Can consider news, politics, and unique market conditions.

- More Explanation: Often includes reasoning or chart analysis.

- Adaptive: Can adjust based on sudden market shifts.

Disadvantages of Manual Forex Signals

- Slower: Depends on the trader’s availability.

- Emotion-Driven: Human errors or emotions can affect decisions.

- Limited Coverage: Can’t monitor all pairs 24/7.

Advantages of Automated Forex Signals

- Fast Execution: Signals delivered instantly.

- 24/7 Monitoring: Bots never sleep—constant market scanning.

- Emotion-Free: Purely data-driven decisions.

Disadvantages of Automated Forex Signals

- Lack of Context: Bots can’t interpret unexpected news.

- Over-Optimization Risk: Bots may work only in specific conditions.

- Technical Failures: Risk of bugs or connection issues.

Which One Should You Choose?

- Manual Signals Are Better If:

- You prefer human judgment.

- You like explanations and learning opportunities.

- Automated Signals Are Better If:

- You want speed and efficiency.

- You trade frequently or around the clock.

Combining Both for the Best Results

Some traders use both types:

- Manual for big market moves or news trading.

- Automated for consistent, high-frequency trades.

Conclusion

Manual and automated forex signals each have unique benefits. In 2025, choosing the right type depends on your trading goals, experience, and how hands-on you want to be. Many traders succeed by blending both for flexibility and efficiency.

FAQs:

- Are automated forex signals more profitable?

Not always. Profitability depends on market conditions and bot quality. - Do manual signals take longer to arrive?

Yes, because they rely on human analysis and timing. - Can I build my own automated signal system?

Yes, using platforms like MetaTrader (EAs) or custom coding. - Are manual signals more accurate?

They can be, especially in volatile or news-driven markets. - Which is better for beginners?

Manual signals offer more learning opportunities, while automated can help with speed.